Revenue Cycle Management

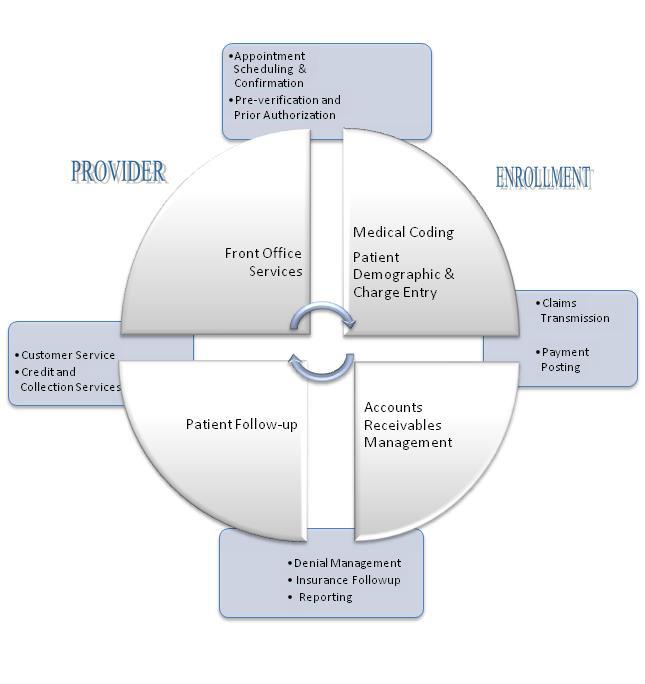

Revenue cycle management increases provider revenue while decreasing the time spent on administrative and clinical functions. This means more money and time devoted to the patient and their treatment.

- RCM

- Patient Demographic Entry

- Insurance eligibility, benefit verification & Prior Authorization

- Medical Coding

- Claims scrubbing or Claims submission

- Payment Posting

- Denial Management Services

- Accounts Receivable Follow-up Services

- Patient Statements review and Balance Collections

Revenue Cycle Management (RCM)

Timely Billing and providing accurate information on the claims for all the accounts is a key of an effective Revenue cycle Management (RCM).

SGTech Solutions focuses on providing quality end-end Revenue Cycle Management Solutions. We provide exceptional services to our clients and have high performance track of seven years.

We add value to our client’s practice while ensuring timely delivery of results with complete customer satisfaction. Strict adherences to the various industry standards and simplified solution have helped us in delivering:

- Improvised Cash Flow

- Decreased claim denials and improved claim accuracy

- Focused Policy and Compliance

- Increased Savings

- Process Transparency

- Superior Patient Relations

Our end-to-end Revenue Cycle Management solution offers either as a complete suite or as a stand-alone service:

- Patient Demographic Entry

- Insurance eligibility, benefit verification & Prior Authorization

- Medical Coding

- Claims scrubbing or Claims submission

- Payment Posting

- Denial Management

- Accounts Receivable Follow-up

- Patient Statements review and Balance Collections

Patient Demographic Entry Services

Healthcare organizations understand the importance of patient demographic data, as it contains every specific detail related to the patient. Every single piece of information provided in the patient demographic sheet is essential in medical billing and coding, as it directly affects the insurance claims payment. Error-free patient demographic entry is required for claims submission, as it provides accurate data that facilitates quick processing of the insurance claims by the insurance company.

If you are finding it hard to keep up with the patient demographic data entry, then outsourcing it can be a great way to ensure successful claims processing. We have well-trained medical billing professionals who can quickly and accurately file all the necessary data from the patient demographic sheet shared with us and send it to the payers, within the client’s working hours. Outsourcing patient demographic entry to us can ensure higher accuracy at lower costs!

Patient Information Validation

Once we receive all the information from the client, our team of medical billing experts will thoroughly review all the documents provided in the file and validate the information. We ensure that all the information is correct and accurate before we enter the data into the medical billing system. If any document or information is missing, we immediately contact the client and retrieve the information.

Patient Demographic Entry`

After all the patient data is correctly validated and checked, we enter the information into the medical billing system. As this step is critical and is responsible for the claims to be settled, we ensure that the information is accurately entered without any errors. The patient demographic data we validate and enter include –

PATIENT DETAILS

Patient name and ID#, Gender, Marital Status, Email, Date of Birth, SSN Number, Contact number, residential address and office address.

GUARANTOR / ACCOUNT DETAILS

Guarantor Name, Date of Birth, Phone number of Work and Home with their respective Address details.

INSURANCE DETAILS

Insurance Identification Number, Name and address of the Insurance company, Group name/ group number, Details of the policy and policy effective date and termination, policy number, Name of the insured, Date of Birth and the relationship of the insured to the patient.

Insurance eligibility & benefit verification Services

Insurance eligibility verification is the first and one of the key steps in the medical billing and coding process. Most of the medical claims are denied or delayed by the insurance companies mainly due to incorrect or inadequate coverage details provided by the patients during their visits or when the current coverage information is not updated by the hospital or administrative staff. This directly impacts the cash flow of the company by delaying the reimbursements.

Outsourcing this to a service provider having an experienced team of medical billing and coding experts, who are updated with all the regular changes in health plans and policies, will prevent delays and denials of insurance claims. We have been offering quick and efficient eligibility verification services Include.

Document Checking

When we receive the documents from the healthcare organizations / insurance providers, we thoroughly analyze all the documents and verify it against the list of the necessary documents. This process helps to organize the documents as needed by the insurance company.

Verifying Patient’s Insurance Coverage

We verify insurance Eligibility & Benefits and insurance coverage details of the patient with the primary and secondary payers either by contacting them directly or by checking their official online insurance portals a day before the scheduled patient encounter. Then we capture and update details in the patient notes – copay, deductible, co-insurance, in-network, and out of network benefits, and PCP name matching.

Patient Follow-up

If required, we promptly contact the patient for follow-up encounters to seek any missing or incorrect information and get the required authorization as a part of our service procedure check. This helps in keeping track of all the information and cross verifying these details before the final submission is made.

Final Submission

We provide the client with the final results, which include the information about the patient’s eligibility and benefits along with other details, such as group ID, member ID, start and end dates of the insurance coverage, copay information, etc.

Benefits of Insurance Eligibility Verification

Insurance eligibility verification services is one of the biggest questions that often bothers most of the healthcare organizations. Verifying medical insurance eligibility of patients is of utmost importance as it directly affects the cash flow of these organizations.

Improves Cash Flow

When there is access to updated eligibility data, the chances of getting the claims quickly accepted and processed are also high. This helps in maintaining a constant cash flow into the organization by reducing denials and write-offs and increasing patient satisfaction.

Streamlines Workflow

Eligibility responses are consistently and concisely viewed, which improves overall efficiency of the process. Following such a consistent and streamlined approach will lead to superior patient experience and fewer denials.

Boosts Self-pay Revenue

By electronically matching self-pay patients with managed Medicaid databases, healthcare providers can get additional reimbursement opportunities. This also helps in identifying patients who unknowingly have coverage, reclassify them and submit their claims, which frees self-pay patients from financial burdens.

Medical Coding

Medical Coding is the process of assigning standardized codes and it is the uniform language that describes medical, surgical and diagnostic services. This is a communication between the Physicians / hospitals, patients and the third parties.

Medical Coding is one of the most sensitive processes of the Revenue Cycle Management preceding a claim submission. Accurate coding increases higher revenues and decreases the denials from the insurance companies. To prevent these types of errors we have our coders who are expertise in Physician coding and are certified by AAPC.

Our experienced coding teams are specialized in specialties including Radiology, Surgery, Family Practice and HHA OASIS documentation and Coding.

The Coding Process includes the following steps:

- Access Patient Medical Records through secured network using VPN Connections.

- Coders review and scrutiny the documents for accuracy and split them into batches for processing.

- Diagnosis, Procedure codes and modifiers are assigned as per the coding guidelines and per client requirements.

- Coding is done in accordance with NCCI (National Correct Coding Initiatives) and LCD (Local Coverage Determination).

- Quality checks are in place prior to the charge Entry Process

Following industry coding standards are used:

- ICD-9 CM (International Classification of Diseases) for Diagnosis codes

- CPT-4 (Current Procedural Terminology) for Procedure codes

- HCPCS (Healthcare Common Procedure Coding System) to code Level II and Level III codes

Highlights

- Accuracy level is maintained at 98%

- The coders are involved in continuing education programs

- SGTech provides coding services with a turnaround time of 24 to 48 hours

- We provide continuous feedback to our client with regard to the changes in the in codes and its selections that affects reimbursements.

- With SGTech you can be confident of ICD-10 compliant and process efficient. Our approach to ICD-10 will also help further streamline the RCM processes.

Claims scrubbing or Claims submission

Claims scrubbing or Claims submission process involves reviewing the claim data before submitting the claims to payers. We utilize the functionality in the practice management systems to check the data integrity. We identify and correct the rejections and work edits before onward submission to insurance payers.

Our Work Edits and Rejection Management Process

Our work edits and rejection management team will resolve any problems with the claims during submission. The result is that you can address your denials upfront and reduce rework on the claim denials.

Edits on the Practice Management System

Prior to claims being staged to claims scrubber application, we review the claims using the system functionality

Bill scrubber edits

Automated claims editing to ensure that the claim data is accurate and manual edits as needed.

Clearinghouse edits

We review all claims thrown out from the clearinghouse systems and manually resolve.

Payer rejections

Once the claims reach the payer, the claims are in denied or partially denied status and upon receipt of the information, we work with payers to refile claims.

Benefits offered by our Claims Submission Team

- Reduce costs by 30-50% through our global delivery model

- Avoid claim denials by addressing issues upfront.

- Improve the Accounts Receivable cycle by reducing the number of claims denied

- Achieve higher and quicker reimbursement

Payment Posting Services

Payment posting allows you to view payments and provides a snapshot of a practice’s financial picture, making it easy to identify issues and solve problems fast.

Being able to see daily Insurance payments from EOBs, insurance checks from ERAs, patient payments and more, having an efficient payment posting system provides an efficient view of your day to day financial picture.

The payment posting process, in many ways, provides a view of the effectiveness of your revenue cycle. It allows you to understand trends in reimbursements and perform analytics. Accurate payment posting offers clarity on the state of your revenue cycle, and, therefore, you must choose a highly efficient team to process payments.

Our Payment Posting Process

We process different types of remittances received we perform the following services.

Patient Payments We receive information on the point of service payments made by patients from our clients. These payments are made via cash/check/credit cards and could be on account of co-pays, deductibles, or non-covered services. Our team reviews the information received and adjusted the same against each patient account.

Insurance Posting: We process Insurance Payments in the following formats

Insurance ERA’S Batch processing of electronic remittance advice (ERA) & corrections of any exceptions and transfer of balance to secondary insurances.

EOB Processing Processing of payments made by insurance companies with out ERA, and transfer of balance to secondary insurances

Denial Posting Posting of claim denials is essential to get an accurate understanding of the customer’s A/R cycle. Denied claims are sent back by the payers in the form of ANSI codes for denials and sometimes with payer-specific medical coding guidelines. We understand the payer-specific denial codes for most payers and have expertise in understanding ANSI standard denial codes. We record each claim denial in the practice management system and take actions to re-bill to the secondary insurance company, transfer the balance to the patient, write-off the amount, or send the claim for reprocessing.

Benefits of our Payment Posting process

Get an accurate understanding of the A/R cycle. Accuracy in payment posting is critical to getting the right view of the state of your accounts receivable, allowing you to make the right decisions.

We generate reports on A/R trends to:

- Understand the reason for denials,

- document the cases requiring eligibility and authorization to improve point of service collections,

- understand the services that are covered or not covered by different payers, and

- learn about the typical time to process payments by your insurance company

Denial Management Services

Denial management is often confused with Rejection Management. Rejected Claims are claims that have not made it to the payer’s adjudication system on account of errors. The billers must correct and resubmit these claims. Denied Claims, on the other hand, are claims that a payer has adjudicated and denied the payment.

To successfully appeal denied claims, the billers must perform a root-cause analysis, take actions to correct the identifies issues, and file an appeal with the payer. To thrive, a healthcare organization must continuously address the front-end processes’ problems to prevent denials from recurring in the future.

Our Denial Management Service Offering

- Investigate the reason for every denied claim

- Focus on resolving the issue

- Resubmit the request to the insurance company

- File appeals where required

We understand that each denial case is unique. We correct invalid or incorrect medical codes, provide supporting clinical documentation, appeal any prior authorization denials, understand any genuine denial cases to pass the responsibility to patients, and follow-up effectively. We re-validate all clinical information before re-submission.

FILING APPEALS

We analyze denial reasons, prepare appeal letters, and refile the claims by attaching clinical documentation and submit the claims via fax appeals in a payer-specific format.

REDUCE DENIALS THROUGH ANALYTICS

Different component processes within the revenue cycle chain can result in claim denials. Often, denial issues are practice-specific or facility-specific. We understand the trends in claim denials and launch an iterative process to reduce them based on specific causes.

Denial management services offers our clients the following benefits

Focus on getting claims resolved. We focus on fixing the claims rather than merely getting the claims status information.

Process Automation

. We cut the effort to check the claims’ status by improving the adoption of web portals to obtain claim status online

- Workflow automation. Each claim status code has a set of questions to be answered by the insurance companies to resolve the claim’s issues. We have defined our claims follow-up work queues with web-based workflow systems that improve the documentation quality.

Dashboards and metrics.We generate multi-variate reports to get a clear view of the A/R and focus our effort on the resolution.

Improving collections and reducing days in A/R.Our clients see a minimum of 20% reduction in days in A/R and improved collections by about 5-7%.

Accounts Receivable Follow-up Services

The number of services provided by physicians, hospitals, and nursing homes are continuously increasing. Each time patients are given treatment and care, they owe a certain amount to the physicians or hospitals.

An effective insurance model helps healthcare organizations in recovering over-due payments from insurance carriers easily and on time. This is when accounts receivable (A/R) follow-ups come into the picture. It helps the healthcare service providers run their practice smoothly and successfully, while ensuring the owed amount is refunded back in as short a time as possible.

The 3 Stages of Medical Billing A/R Follow-up

Most of the medical billing specialists perform the A/R follow-up in a very systematic manner, which is usually conducted in three stages:

Stage 1: Initial Evaluation

This stage involves the identification and analysis of the claims listed on the A/R aging report. The team reviews the provider’s policy and identifies which claims need to be adjusted off.

Stage 2: Analysis and Prioritizing

This phase is initiated once the claims are identified which are marked as uncollectible or for claims where the carrier has not paid according to its contracted rate with the healthcare provider.

Stage 3: Collection

The claims identified to be within the filing limit of the carrier are re-filed after verifying all the necessary billing information such as claims processing address and conformation to other medical billing rules. After completing the posting of payment details for outstanding claims, patient bills are generated as per the client guidelines and then followed up with the patients for payments.

Roles and Responsibilities of A/R Specialists

There is a massive amount of work to be done before the physician can claim an amount from the insurance firm. Ideally an A/R team comprises of two departments –

A/R analytics

The A/R analytics team is responsible for studying and analysing denied claims as well as partial payments. Also, if any claim is found to have a coding error, the A/R team corrects it and resubmits the claim.

A/R follow-up

The A/R follow up team on the other hand constantly communicates with patients, healthcare service providers, and the insurance firms and takes necessary actions based on their feedback or responses. The skills and quality of services delivered by the A/R team eventually helps in determining the financial health of a healthcare practice.

Patient Statements review and Balance Collections

Patient statements give you the ability to streamline your billing and payment process for

your patients, reducing costs and saving time. You can also leverage the traditional print and mail statement workflow to create a fully electronic experience.

It is most effective to ask for payment while the patient is still in the office, we work in close proximity on appointment basis & Point-of-service collections. Our Team familiar and well Trained with insurance benefits as well as how to ask for payment upfront.

Here are the methods we follow on patient statements to stream line the Practice Revenue

- Portal-driven online bill-pay

- Mobile payment methods

- Generation of statements

- Printing of patient statements

- Mailing of statement

Roles and Responsibilities of A/R Specialists

There is a massive amount of work to be done before the physician can claim an amount from the insurance firm. Ideally an A/R team comprises of two departments –

A/R analytics

The A/R analytics team is responsible for studying and analysing denied claims as well as partial payments. Also, if any claim is found to have a coding error, the A/R team corrects it and resubmits the claim.

A/R follow-up

The A/R follow up team on the other hand constantly communicates with patients, healthcare service providers, and the insurance firms and takes necessary actions based on their feedback or responses. The skills and quality of services delivered by the A/R team eventually helps in determining the financial health of a healthcare practice.